August 1, 2025 | 21:12 GMT +7

August 1, 2025 | 21:12 GMT +7

Hotline: 0913.378.918

August 1, 2025 | 21:12 GMT +7

Hotline: 0913.378.918

Vietnamese lychee has the opportunity to increase sharply in market share in Japan.

According to the Vietnam Trade Office in Japan, so far Japan has mainly imported fresh lychees from China and Taiwan. China had always been Japan’s largest fresh lychee exporter until 2016. In 2017 and 2018, China lost the No. 1 position but returned to the leading position in exporting lychee to Japan in 2019.

Vietnam exported fresh lychee to Japan for the first time in 2020. Statistics of Japan Customs show that, in the first year of entering the Japanese market, Vietnamese lychee accounted for about 10% of the market share in the Japanese market, ranking third, after Chinese and Taiwanese lychees.

As 2020 is the first year, Japanese companies importing Vietnamese lychees still hesitantly probe the market reaction. However, because Vietnamese lychees have created good effects, Japanese companies have planned to increase Vietnamese lychee import amount many times this year. Therefore, Vietnamese lychee is expected to increase its market share in Japan.

A year later after entering the Japanese market, Vietnamese lychees have resounded in the land of the rising sun. When it was first launched at the AEON supermarket chain in June 2020, Thieu lychee was enthusiastically received by Japanese consumers as well as the Vietnamese community living and working in Japan.

The Japanese people praise the freshness of Vietnamese lychees. They have also bought them as a gift for their family and friends. Many Japanese consumers say that they have never eaten such delicious and mildly scented lychees before. They share their feelings about the taste, the way to eat, about the selling price, about which supermarket system should lychees be put in to improve its value.

Moreover, the number of Vietnamese living and working in Japan has increased rapidly in recent years, making the image and demand for Vietnamese agricultural food and products, including Thieu lychee, more and more popular in the Japanese markets. In addition to Japanese supermarket chains, this year, many businesses and shops owned by Vietnamese people stood up to import lychees, sell them directly or online to serve the Vietnamese community in all parts of Japan.

Vietnamese Thieu lychee exported to Japan.

As claimed by Mr. Ta Duc Minh, Vietnam's Trade Counselor in Japan, Japan is a market with high standards on food safety and hygiene, especially for imported agricultural and fishery food and products. Although the production volume of lychee in Japan is still very low (only 5% of the market share and there are very few localities in Japan with a suitable climate to grow lychee) and Japan almost depends on fresh lychees imported from abroad, Japan only allows the import of products that meet the set standards.

Therefore, it took Vietnam more than 5 years to negotiate, strictly implement strict regulations and standards, from the lychee varieties selection, registration of planting areas, fertilizing, pest control, harvesting, to the search for export partners, price negotiation... to then successfully penetrate the Japanese market.

(VAN) The Nhon Hai Purple Shallot Agricultural Cooperative recently began exporting about 3 tons of shallots weekly, becoming the first in the former Ninh Thuan province to do so.

(VAN) OCOP products from Quang Ninh are gradually reaching international markets, with a focus on nationally certified 5-star products.

(VAN) After a sharp decline in the early months of the year, Vietnam's durian exports are experiencing a strong recovery, driving the overall rebound in fruit and vegetable exports.

(VAN) The volume of durians imported through Guangxi has surged as the region invests in logistics infrastructure and takes advantage of tariff incentives from the RCEP agreement between China and ASEAN.

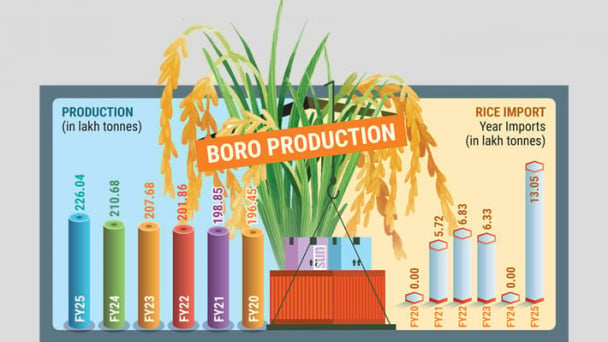

(VAN) Rice prices in Bangladesh have shot up over the past year, rising by as much as 16%, despite a record-breaking harvest this season and large volumes of imports in 2024-25 fiscal year.

(VAN) U.S. seafood tariffs trigger major disruptions in global supply chains. Vietnam proactively shifts markets and strengthens internal capacity to maintain its export position.

/2025/07/26/1437-0-nongnghiep-221433.jpg)

(VAN) To achieve successful exports, Vietnamese agricultural products must tell a product story that aligns with current trends and reaches to the needs and emotions of international consumers.