July 28, 2025 | 16:35 GMT +7

July 28, 2025 | 16:35 GMT +7

Hotline: 0913.378.918

July 28, 2025 | 16:35 GMT +7

Hotline: 0913.378.918

Even in just the past two months, prices have seen steady increases.

This sharp increase is making life even more challenging for limited- and low-income families who are already struggling to keep up with the rising cost of living.

Figures from the Trading Corporation of Bangladesh (TCB) show that fine rice has become 15.94% more expensive compared to last year, while medium-quality rice is up by 16.07% and coarse rice by 10.58%.

Even in just the past two months, prices have seen steady increases. In June, the contribution of rice to overall food inflation surged dramatically – from 40% in May to 50% – with medium-grade rice alone accounting for 25%, as noted in the “July 2025 Economic Update” published by the General Economics Division (GED) of the Planning Commission.

This inflationary spike comes despite a bumper Boro crop and a sharp rise in rice imports, raising questions about market dynamics and supply chain integrity. Record production, but rising prices

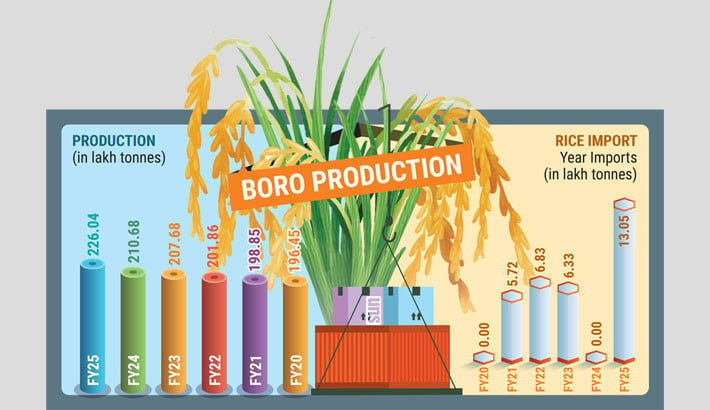

This year, Bangladesh witnessed the highest Boro paddy production in its history. According to data from the Department of Agricultural Extension (DAE), farmers cultivated Boro paddy on 50.465 lakh hectares of land with a target of 226.002 lakh tonnes of rice.

The country saw much higher Boro paddy production this year – 15 lakh tonnes more when compared to last year,” noted Agriculture Adviser Lt Gen (retd) Md Jahangir Alam Chowdhury, adding, “Yet, neither farmers nor consumers are benefitting. Farmers have largely sold off their paddy, and traders now dominate the supply chain, resulting in steep price hikes.”

Agricultural economist Dr Jahangir Alam Khan observed, “Farmers no longer have paddy; most of it is now in the hands of rice mill owners and traders. They are speculating that if the market price goes up, they will profit. So, they are stockpiling and releasing rice slowly.” He warned that the government’s limited reserves hamper its ability to stabilise the market.

"Currently, the government has around 1.4 million tonnes of paddy and rice combined in reserve. In contrast, traders hold over 10 million tonnes. That’s why they are manipulating the market,” he said.

The government claims to be attempting to contain the situation, but has so far failed to bring prices down. Despite bumper production and increased imports, retail and wholesale rice prices remain stubbornly high, fuelling speculation and hoarding in the market.

According to Ministry of Food records, Bangladesh imported approximately 13.05 lakh tonnes of rice in fiscal year 2024-25 (FY25) alone, marking the second-highest volume in the country’s history after the 97.74 lakh tonnes imported in FY18.

Over the past several fiscal years, rice import volumes in Bangladesh have varied significantly. In the FY24 fiscal year, there were no rice imports at all. In the previous year, FY23, the country imported 633,000 tonnes of rice, while in FY22, the figure was slightly higher at 683,000 tonnes. In the FY21 fiscal year, rice imports stood at 572,000 tonnes. Similarly to FY24, there were no rice imports in FY20. Going further back, in FY19, only 65,383 tonnes of rice were imported.

Yet, rice prices have failed to stabilise. The GED Economic Update cited multiple factors contributing to the price spiral, including increased costs of inputs such as fertilisers, seeds, irrigation, and labour; post-harvest losses estimated at 26%; higher transport costs; and market volatility leading to stockpiling.

The report emphasised the need to investigate whether the issue lies in actual shortages or disruptions in the supply chain.

At the retail end, traders confirm the upward trend in prices.

Md Polsah of Matlab Traders in Mirpur 13 told the Daily Sun that a 50kg sack of Mozammel brand miniket rice rose from Tk3,700 on 1 June to Tk4,020 by 21 July. Rashid brand miniket increased from Tk3,300 to Tk3,480, BR 28 rose from Tk2,680 to Tk2,850, and Paijam went from Tk2,750 to Tk2,980 over the same period.

Farhad Hossain Chakdar, general secretary of the Naogaon Rice Mill Owners Association, blamed a legacy corporate syndicate established under the previous government.

“The price of paddy has increased at the market, which is why rice prices have also gone up,” he stated.

According to the Bangladesh Bureau of Statistics (BBS), production of Aus and Aman rice in the last fiscal year dropped by about 3,21,000 tonnes compared to the previous year. Specifically, Aus production declined by 6%. The BBS has not yet released the final Boro production estimate, though initial reports suggest a record high.

Experts say the persistently high prices highlight a lack of effective market intervention and regulatory oversight.

“If the government had adequate stock, it could intervene. But it doesn’t,” said Dr Khan. “Due to this lack of intervention, traders are controlling the market and making excessive profits.”

daily-sun

(VAN) U.S. seafood tariffs trigger major disruptions in global supply chains. Vietnam proactively shifts markets and strengthens internal capacity to maintain its export position.

/2025/07/26/1437-0-nongnghiep-221433.jpg)

(VAN) To achieve successful exports, Vietnamese agricultural products must tell a product story that aligns with current trends and reaches to the needs and emotions of international consumers.

(VAN) Over 600,000 Vietnamese coffee farming households face major challenges as the EU tightens traceability and anti-deforestation requirements by the end of 2025.

(VAN) By leveraging advanced production technology, Tan Nhien has exported Vietnamese rice paper to over eight countries, winning over customers with its convenience and quality.

(VAN) Ministry of Agriculture and Environment, in coordination with relevant parties, is finalizing the legal framework to enable carbon credits from JCM projects to be traded smoothly on Vietnam's carbon exchange.

(VAN) Food prices have been quickly climbing for years now, and now there’s another staple that could see prices soon shoot up: tomatoes.