September 14, 2025 | 18:52 GMT +7

September 14, 2025 | 18:52 GMT +7

Hotline: 0913.378.918

September 14, 2025 | 18:52 GMT +7

Hotline: 0913.378.918

Mr. Nguyen Thanh Loc, Chairman of the Ho Chi Minh City Fisheries Association, stated that most seafood processing businesses in the Ba Ria-Vung Tau area focus on products made from wild-caught raw materials such as octopus, squid, anchovy, threadfin, and striped tuna. The processed products mainly fall into two categories: frozen seafood (whole, fillets, or breaded) and dried seafood (dried squid and sun-dried or dehydrated seafood, with or without seasoning).

“However, over 90% of export products are still sold under foreign importers’ brands. Vietnamese companies mainly act as contractors, without building their own supply chains or distribution networks, resulting in thin profit margins and limited access to direct EU consumer demand,” Mr. Loc noted.

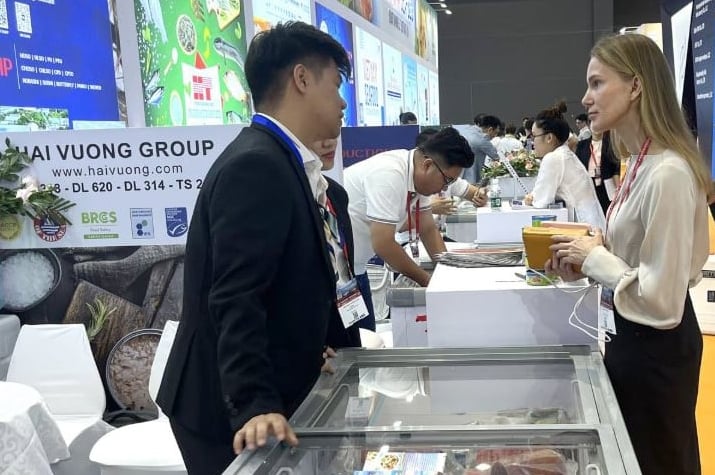

Vietnamese seafood companies are stepping up trade promotion efforts and seeking more opportunities to enter the EU market. Photo: Le Binh.

Notably, Vietnamese companies' processing capacity is by no means inferior. Machinery and equipment are imported from Japan, South Korea, Germany, and the Netherlands, and the direct labor force is abundant and highly skilled. However, the indirect workforce—responsible for sales and accessing international markets—remains weak, lacking practical experience and confidence to operate independently in the EU.

As a result, over the past five years, export turnover to the EU for many businesses in Ba Ria–Vung Tau has dropped by 70-80%. Many members of the Fisheries Association have had to shift to other markets, accepting low profit margins.

Unlike many contract manufacturers, HaiVuong Group (HVG), a major tuna company in Vietnam, presents a picture full of both opportunities and challenges in EU integration.

According to Mr. Nguyen Van Du, Director of HaiVuong Vietnam Tuna Co., Ltd (HVG), the group’s revenue in 2024 reached USD 301 million, with nearly USD 68 million (22.78%) coming from the EU. With five modern factories, cold storage capacity exceeding 30,000 tons, and over 3,000 skilled workers, HVG exports more than 60,000 tons of finished products annually, covering over 40 countries.

“The company meets numerous international standards, including HACCP, BRC, Dolphin Safe, MSC, along with a transparent traceability system from fishing vessels to the dining table. The EVFTA allows HVG to leverage tariff benefits and strengthen its competitive edge,” Mr. Du said.

Despite being a large, capable, and reputable exporter of tuna to the EU, HaiVuong Group is also facing numerous challenges. Photo: Le Binh.

Nevertheless, HVG still faces significant challenges. The IUU yellow card remains the largest non-tariff barrier, subjecting exports to the EU to strict scrutiny. In addition, high production costs, global logistics fluctuations, and fierce competition from Thailand, Indonesia, and South America also reduce profit margins.

Mr. Du emphasized that maintaining EU market share requires coordinated support: from lifting the IUU yellow card, to green transition investment funds, trade promotion centers in Europe, and a communication strategy to build the brand of Vietnamese seafood.

According to the Ho Chi Minh City Fisheries Association, for businesses to overcome these challenges, the government must act swiftly to remove regulations that are outdated or impractical in fisheries management, which currently hinder operational efficiency and compliance. In addition, it is essential to establish comprehensive mechanisms to support the development of skilled human resources capable of navigating international markets. This includes training programs for sales and marketing staff, workshops on export procedures and standards, and initiatives to help companies understand and meet the expectations of global buyers.

At the enterprise level, it is necessary to link production, processing, and distribution chains to create collective strength rather than isolated efforts. Some experienced exporters such as Baseafood, Hai Viet, and Coimex are expected to become leading "anchors", guiding and supporting other companies in entering the EU market.

"We have modern machinery and a highly skilled workforce, but if the IUU bottleneck is not removed and an effective distribution system is not established, these advantages cannot be converted into real market value in the EU," said Mr. Nguyen Thanh Loc, Chairman of the Ho Chi Minh City Fisheries Association. He emphasized that technical capacity alone is not enough; strategic market access, strong brand presence, and supply chain integration are equally critical. Without these elements, Vietnamese seafood businesses risk remaining mere processors for foreign brands rather than becoming independent players capable of directly capturing EU consumer demand.

Translated by Kieu Chi

(VAN) The EU is tightening environmental and sustainability standards, making the greening of supply regions an inevitable path for Vietnamese seafood.

(VAN) A new mechanism at Guangzhou Baiyun International Airport is boosting the competitiveness of imported durians in Guangzhou compared to the two southern gateways, Guangxi and Yunnan.

(VAN) From January 2026, seafood caught in 12 Vietnamese fisheries may be banned from entering the United States after failing to meet equivalency standards under the Marine Mammal Protection Act.

(VAN) The prolonged absence of Chinese buying is expected to weigh further on benchmark Chicago soybean futures , already hovering near five-year lows.

(VAN) Vietnam's rice sector is moving beyond its reputation for fragrant, specialty varieties such as ST24, ST25, and DT8. Focusing on health-oriented, emission-reducing rice, the sector is now positioning itself for sustainable growth.

/2025/09/11/0302-2-155633_317.jpg)

(VAN) Vietnam's rice sector has undergone a major transformation from mass production of medium- and low-grade rice to high-grade, fragrant varieties. This shift has helped Vietnamese rice secure a stronger position in the global market.