September 9, 2025 | 16:02 GMT +7

September 9, 2025 | 16:02 GMT +7

Hotline: 0913.378.918

September 9, 2025 | 16:02 GMT +7

Hotline: 0913.378.918

The 2024–2025 season marked a milestone for Vietnam’s sugar industry. Average sugar yields reached 6.69 tonnes per hectare, outpacing Thailand (5.20), Indonesia (4.76), and the Philippines (4.62), making Vietnam the regional leader. This achievement reflects sweeping changes in crop varieties, cultivation techniques, and pest management.

Mr. Nguyen Van Loc, Chairman of the Vietnam Sugarcane and Sugar Association, shared the advantages and difficulties in the 2024-2025 crop year. Photo: Bao Thang.

According to the Vietnam Sugar and Sugarcane Association (VSSA), the sugarcane area in 2024 reached 185,484 hectares, up more than 10,600 hectares from the previous year. The average yield climbed to 68.3 tonnes per hectare, higher than in 2023, pushing national cane output to 12.67 million tonnes, a 7% rise.

Harvested area in 2024 - 2025 reached 189,360 hectares, generating 12.43 million tonnes of crushed cane, up more than 16% year-on-year. Sugar output surpassed 1.26 million tonnes, up 14.3%.

One of the most significant shifts came from varietal restructuring. In 2018, the KK3 variety accounted for only 18.5% of acreage, but by 2024 it had surged to 68.3%, or 124,649 hectares. Once-dominant varieties such as K95-84, ROC22, and Suphanburi 7 fell below 3%. The industry has also emphasised disease-resistant varieties capable of withstanding droughts and floods.

Regional shifts have also been stark. The Central and Central Highlands now account for 61% of total cane output (7.67 million tonnes), a 219% increase compared to 2020 - 2021. The North contributes 28%, the Southeast 8%, and the Mekong Delta just 3%.

Pest management has been stepped up, with coordinated measures against smut, rust, woolly aphids, and root borers laying the foundation for high yields. Farm-gate cane prices in 2024 - 2025 averaged 1.2 - 1.3 million VND per tonne, far higher than 823,617 VND in 2019 - 2020. At this level, farmers have clear profits, expand their acreage, and remain committed to the crop.

In just five years, crushed cane output jumped from 6.7 million tonnes (2020–2021) to 12.4 million tonnes, while sugar production nearly doubled from 689,830 tonnes to 1.266 million tonnes. Yet despite leading ASEAN in sugar yields, domestic sugar prices remain low, only 66% of those in the Philippines, 70% of Indonesia, and 94% of China.

Sugarcane harvest in Nghe An province. Photo: Tri Tue.

Even as production and yields rise, Vietnam still imports significant volumes. Customs data show that in 2024, sugar imports reached 788,372 tonnes, higher than in 2023. Thailand supplied nearly 35%, Australia 18.3%, Indonesia 10.4%, and Myanmar 7.7%.

Experts warn that Vietnam's yield advantage will not translate into lasting competitiveness without restructuring, cost reduction, and diversification into higher-value products.

The sugar industry forecasts continued growth in 2025–2026, with both acreage and output surpassing the previous season. VSSA projects 201,287 hectares harvested, up more than 12,000 hectares from 2024–2025. Processed cane is expected to reach 13.34 million tonnes, up 7.3%, with average yields of 67.3 tonnes per hectare, 1.3 tonnes higher than the prior season.

Sugar output is targeted at 1.37 million tonnes, an 8.2% rise, extending a five-year growth streak. Twenty-five mills are expected to remain in operation, with a combined design capacity of about 124,000 tonnes of cane per day, enough to handle the larger harvest.

Factories aim to keep production stable, meeting domestic demand while ensuring a steady supply for the market.

Yet challenges loom. Chief among them is the influx of sugar of unclear origin. In addition, imported corn syrup has risen sharply, adding direct pressure to the domestic market. VSSA cautions that without effective controls, expanding cane acreage and output will not yield sustainable returns.

Director of the Department of Quality, Processing and Market Development Ngo Hong Phong: 'The biggest challenge facing the sugar industry today is high production costs'. Photo: Bao Thang.

Ngo Hong Phong, Director General of the National Authority for Agro-Forestry-Fishery Quality, Processing and Market Development (NAFIQPM), emphasised that “the biggest challenge for the sugar industry today is high production costs.” He said the authorities are working with associations and businesses to address bottlenecks, but urged firms to take initiative and find their own solutions rather than rely solely on government support.

Mr. Phong argued that for the sector to move forward, it must go beyond boosting output to address market issues and restructure production. Crop-based industries are reaching growth ceilings, he noted, meaning a shift toward efficiency and value creation is essential.

For sugar, that means cutting costs by reviewing production processes and strengthening raw material linkages. He stressed that only with controlled costs can businesses withstand competition from foreign producers.

According to the Ministry of Agriculture and Environment, sustainability in sugar lies not only in cost control but also in value-added strategies. Instead of focusing solely on refined sugar, the industry should maximise by-products: producing ethanol from molasses, generating power from bagasse, making organic fertiliser from filter mud, and turning fibres into paper and packaging.

Deep processing should also be expanded into niche markets such as organic sugar, rock sugar, liquid sugar, and low-calorie sweeteners. By diversifying, companies can tap higher-value segments.

When a single cane plant can generate multiple products, its economic worth far exceeds that of sugar alone. This approach offers a pathway to reduce competitive pressures, open opportunities for modern development, and improve incomes for both businesses and farmers.

* USD 1 = VND 26,415 (Vietcombank)

Translated by Linh Linh

(VAN) This is the first time that Vietnam will host the 8th Asian Organic Congress, to exchange on policies, markets, organic farming practices.

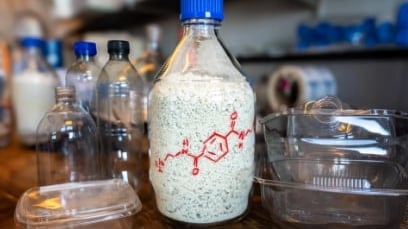

(VAN) Chemists at the University of Copenhagen have developed a method to convert plastic waste into a climate solution for efficient and sustainable CO2 capture, thereby addressing not one, but two major global challenges.

(VAN) The Hanoi People’s Committee and the United Nations Development Programme (UNDP) signed a memorandum of understanding, reaffirming their commitment to expand cooperation across six areas.

(VAN) Policy dialogue on the marine economy is an opportunity for Vietnam, Japan to exchange experiences on policies for managing and developing a blue economy.

(VAN) Dr Hung Nguyen-Viet has been appointed Regional Director for ILRI Asia, and will be based at the ILRI Vietnam Office in Hanoi.

(VAN) Pu Mat National Park, Dong Nai Culture and Nature Reserve, and Xuan Thuy National Park are Vietnam’s three newly designated ASEAN Heritage Parks.