November 20, 2025 | 12:19 GMT +7

November 20, 2025 | 12:19 GMT +7

Hotline: 0913.378.918

November 20, 2025 | 12:19 GMT +7

Hotline: 0913.378.918

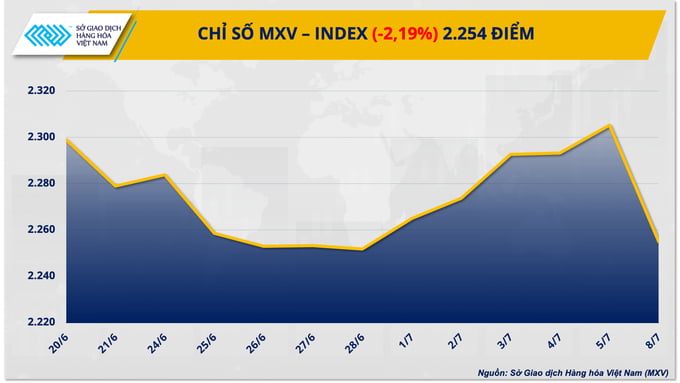

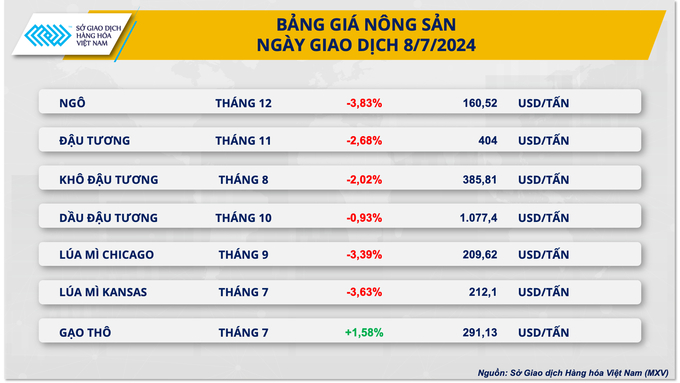

At the close of trading early this week, most agricultural commodities weakened across the board. Corn prices dropped nearly 4%, hitting their lowest level in four years and experiencing the most significant decline among agricultural commodities. Positive supply prospects from the U.S. and Brazil exerted pressure on corn prices yesterday.

In the US, flood-affected areas in the northern Midwest are expected to receive only light rain showers instead of the previously forecasted heavy rains. Meteorologists indicate that the remnants of Hurricane Beryl, expected to move towards the eastern Corn Belt by the end of this week, will bring beneficial rainfall to areas of Illinois and Indiana, where precipitation has been limited in recent weeks. In the western Corn Belt, drier weather is forecasted for next week, reducing flooding in previously inundated areas. Improved seasonal conditions are expected to boost supply expectations in the U.S., putting downward pressure on prices.

In addition, Brazil is expected to significantly boost exports starting this month due to rapid corn harvesting. Consulting firm AgRural reported that as of July 4, Brazil has harvested 63% of this year's second corn crop, up from 49% recorded the previous week and much higher than the 26% at the same time last year. Dry weather with above-average temperatures in most agricultural areas has facilitated harvesting activities.

Similarly, wheat prices also saw a sharp decline of over 3% yesterday. Russia's accelerated harvesting is creating seasonal pressures on the market, weakening wheat prices.

Consulting firm SovEcon noted that as of June 28, Russian farmers have harvested 6.9 million tons of wheat on 1.47 million ha of land. This significantly exceeds last year's figures when harvesting activities had just begun in some regions. Dry weather conditions this year have supported farmers in ramping up their harvest, adding new supplies to the market.

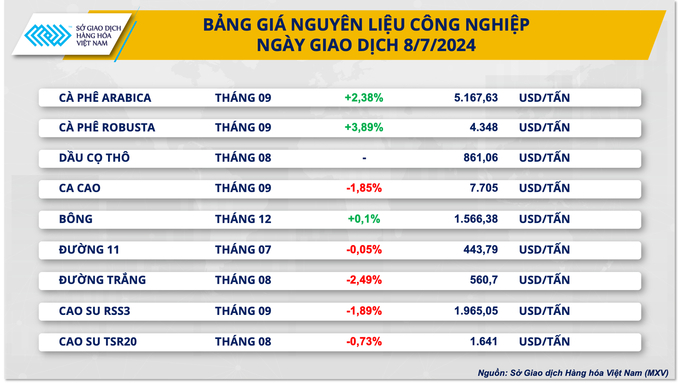

The prices of both Arabica and Robusta coffee surged in the opening session of the week. Specifically, Arabica coffee prices rose by 2.38% to $ 5,167.63/ton. Robusta coffee prices increased by 3.89% to $ 4,348/ton, marking the third consecutive session of strong gains. The market's attention is focused on concerns over coffee supply shortages in Vietnam.

Conversely, cocoa prices fell by 1.85% to $ 7,705/ton as supply showed signs of improvement.

Translated by Hoang Duy

(VAN) More than 100 shoppers queued for a chance to get a kilo or so of Japanese rice for 500 yen ($3.32) by heaping as much grain into a small wooden box as possible.

(VAN) Benchmark international prices of milled declined in October as harvests started or improved in some parts of the globe.

(VAN) Show cause orders will be issued to retailers who sell imported rice at prices exceeding the maximum suggested retail price (MSRP) of P43 per kilo, Philippines Agriculture Secretary said in a statement on Thursday.

(VAN) Coffee prices on October 20, 2025, remained stable domestically, trading at 113,500–114,500 VND/kg. Similarly, global coffee prices also moved sideways.

(VAN) By October, Vietnam’s coffee exports had surpassed USD 7 billion for the first time and will exceed USD 8 billion within this year.

(VAN) Illinois rancher says Texas, Oklahoma, Kansas lost grass and forage, forcing massive cattle liquidation.

(VAN) Coffee prices on October 12, 2025, remained flat, trading at VND 113,000–VND 114,000/kg. This week, coffee prices continued to decline sharply.