August 2, 2025 | 06:28 GMT +7

August 2, 2025 | 06:28 GMT +7

Hotline: 0913.378.918

August 2, 2025 | 06:28 GMT +7

Hotline: 0913.378.918

The International Organisation of Vine and Wine said health concerns and economic factors were to blame for the downturn. Photo: Brian Jackson/Alamy.

Worldwide consumption of wine fell in 2024 to its lowest level in more than 60 years, the main trade body has said, raising concerns about new risks from US tariffs.

The International Organisation of Vine and Wine (OIV) said on Tuesday that 2024 sales fell 3.3% from the previous year to 214.2m hectolitres.

The OIV, whose report was based on government figures, said this would be the lowest sales figure since 1961, when sales were 213.6m hectolitres.

Production is also at its lowest level in more than 60 years, having fallen 4.8% in 2024 to 225.8m hectolitres.

The OIV’s statistics chief, Giorgio Delgrosso, said the wine industry had been hit by a perfect storm as health concerns drive down consumption in many countries and economic factors added to troubles.

“Beyond the short-term economic and geopolitical disruptions, it is important to consider the structural, long-term factors also contributing to the observed decline in wine consumption” the IOV’s annual report said.

The OIV said the consumer was now paying about 30% more for a bottle now than in 2019-20 and overall consumption had fallen by 12% since then.

In the United States, the world’s top wine market, consumption fell 5.8% to 33.3m hectolitres.

Delgrosso said tariffs ordered by the US president, Donald Trump could become “another bomb” for the wine industry.

Sales in China remain below pre-Covid levels. In Europe, which accounts for nearly half of worldwide sales, consumption fell 2.8% last year. In France, one of the key global producers, 3.6% less wine was consumed last year. Spain and Portugal were among the rare markets where consumption increased.

The OIV said production had been hit by environmental extremes such as above-average rainfall in some regions and droughts in others.

Italy was the world’s top producer with 44m hectolitres, while France’s output fell 23% to 36.1m hectolitres, its lowest level since 1957.

Italy is also the biggest wine exporter and its trade increased because of the popularity of sparkling wines such as prosecco.

Spain produced 31m hectolitres, while US wine output fell 17.2% to 21.1m hectolitres, mainly because of extreme heat.

The OIV could not predict if consumption would take off again and industry players, such as the French chain of wine shops Nicolas, say there is a “generational” fall in drinking.

“People do not drink in a festive way any more and young people consume less than their parents,” the company said in a statement to Agence France-Presse.

However, “people drink less, but better”, Nicolas said, and so are ready to spend more.

(The Guardian)

(VAN) The Nhon Hai Purple Shallot Agricultural Cooperative recently began exporting about 3 tons of shallots weekly, becoming the first in the former Ninh Thuan province to do so.

(VAN) OCOP products from Quang Ninh are gradually reaching international markets, with a focus on nationally certified 5-star products.

(VAN) After a sharp decline in the early months of the year, Vietnam's durian exports are experiencing a strong recovery, driving the overall rebound in fruit and vegetable exports.

(VAN) The volume of durians imported through Guangxi has surged as the region invests in logistics infrastructure and takes advantage of tariff incentives from the RCEP agreement between China and ASEAN.

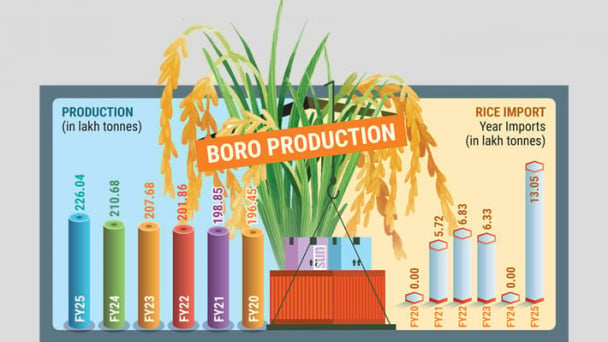

(VAN) Rice prices in Bangladesh have shot up over the past year, rising by as much as 16%, despite a record-breaking harvest this season and large volumes of imports in 2024-25 fiscal year.

(VAN) U.S. seafood tariffs trigger major disruptions in global supply chains. Vietnam proactively shifts markets and strengthens internal capacity to maintain its export position.

/2025/07/26/1437-0-nongnghiep-221433.jpg)

(VAN) To achieve successful exports, Vietnamese agricultural products must tell a product story that aligns with current trends and reaches to the needs and emotions of international consumers.