July 31, 2025 | 02:02 GMT +7

July 31, 2025 | 02:02 GMT +7

Hotline: 0913.378.918

July 31, 2025 | 02:02 GMT +7

Hotline: 0913.378.918

The country has become a leader in the phosphorus market due to its rich deposits of phosphate rock and a well-established fertilizer industry. Additionally, Poland's strategic location in Europe enhances its ability to supply fertilizers to neighboring agricultural markets, further driving its market growth.

The global Melamine Pyrophosphate Market is expected to attain a valuation of USD 324.65 million in 2023 and is projected to reach USD 580 million by 2033, and is expected to rise at a CAGR of 6%.

The global phosphate market, valued at USD 17,576.2 million in 2024, is poised for steady growth, projected to reach USD 23,503.8 million by 2034, with a compound annual growth rate (CAGR) of 2.9% during the forecast period. This growth is driven by increasing demand in agriculture for high-efficiency fertilizers to support global food security, as well as expanding applications in industrial sectors such as water treatment and detergents. Sustainability trends and technological advancements further enhance the market's potential, particularly in emerging regions like Asia-Pacific and Africa, where agricultural modernization is accelerating.

Phosphate, a key component in agriculture, industrial applications, and food production, plays a critical role in meeting global food demands and sustaining modern industries. The market for phosphate is experiencing transformative growth, driven by innovation, evolving agricultural practices, and heightened awareness of sustainability.

Key Takeaways

"The phosphate market's trajectory highlights its critical role in global agriculture and industry. As the demand for sustainable practices intensifies, innovation and diversification will be key drivers. Stakeholders should focus on integrating eco-conscious solutions and tapping into emerging markets to ensure sustained growth and competitiveness," says Nikhil Kaitwade, Associate Vice President at Future Market Insights (FMI).

Leading Phosphate Brands

globenewswire

(VAN) After a sharp decline in the early months of the year, Vietnam's durian exports are experiencing a strong recovery, driving the overall rebound in fruit and vegetable exports.

(VAN) The volume of durians imported through Guangxi has surged as the region invests in logistics infrastructure and takes advantage of tariff incentives from the RCEP agreement between China and ASEAN.

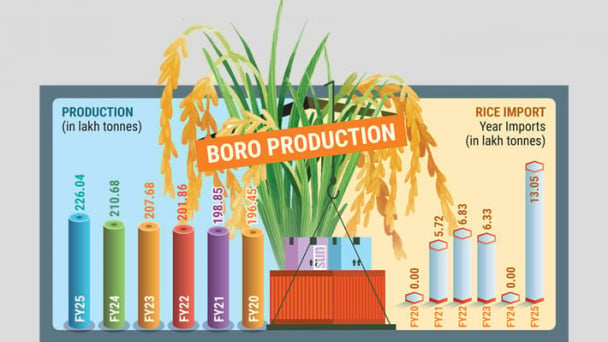

(VAN) Rice prices in Bangladesh have shot up over the past year, rising by as much as 16%, despite a record-breaking harvest this season and large volumes of imports in 2024-25 fiscal year.

(VAN) U.S. seafood tariffs trigger major disruptions in global supply chains. Vietnam proactively shifts markets and strengthens internal capacity to maintain its export position.

/2025/07/26/1437-0-nongnghiep-221433.jpg)

(VAN) To achieve successful exports, Vietnamese agricultural products must tell a product story that aligns with current trends and reaches to the needs and emotions of international consumers.

(VAN) Over 600,000 Vietnamese coffee farming households face major challenges as the EU tightens traceability and anti-deforestation requirements by the end of 2025.

(VAN) By leveraging advanced production technology, Tan Nhien has exported Vietnamese rice paper to over eight countries, winning over customers with its convenience and quality.