August 2, 2025 | 16:00 GMT +7

August 2, 2025 | 16:00 GMT +7

Hotline: 0913.378.918

August 2, 2025 | 16:00 GMT +7

Hotline: 0913.378.918

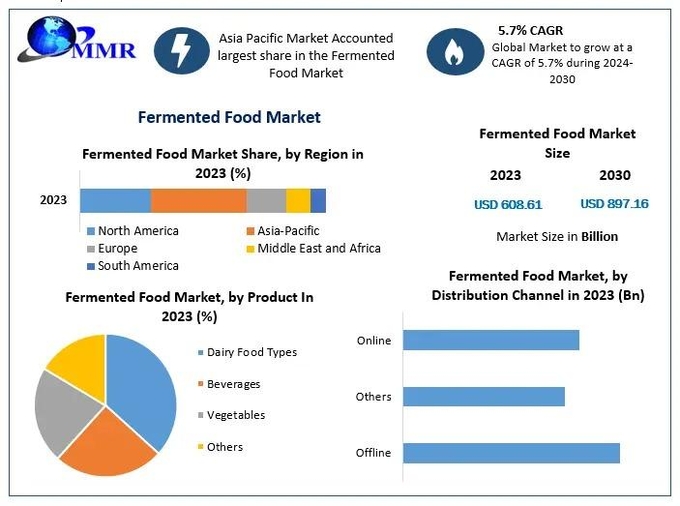

Fermented Food Market.

The fermented food market is witnessing significant growth due to interest in gut health and natural foods. Probiotics in fermented foods are popular due to their role in improving digestion, boosting immunity, and supporting overall health. The connection between gut health and well-being is driving people to holistic food options.

Fermented foods made typically made with simple, organic ingredients, align with the clean-label trend. The absence of artificial additives and natural preservation methods appeal to health-conscious consumers.

The innovation is helping diversify the market by offering diverse flavors, textures, and health benefits. The advancements are allowing to produce vegan, gluten-free, and low-sugar options. Improved control of the fermentation process ensures consistency, quality, and safety, meeting consumer expectations and expanding market reach.

Allergy issues and safety concerns present as challenging. Contamination risks severe health reactions, deterring consumers and harming brand reputation. High cost of production and the shorter shelf life are also some of the main challenges in the fermented foods market.

Asia Pacific Dominates Fermented Food Market

Asia Pacific is the leading region in the fermented food market, with rising interest in gut health and probiotics driving demand. The region's focus on health-conscious diets and the widespread consumption of probiotic-rich foods contribute to its dominance and are expected to sustain growth in the coming years.

Trends in the news section of fermented foodsThe surge of interest and innovation in the fermented foods market is driven by health benefits, sustainability concerns, and technological advancements. Precision fermentation is emerging as a promising technology. The cost competitiveness and consumer perception regarding sustainability needs to be addressed. Many studies focused on effects of fermented foods are helping the market grow. The growth of precision fermentation in Europe and the subsequent reports indicates increased interest and efforts towards standardization of this technology. The entry of fermented foods in pet food industry marks a significant step towards commercializing precision fermentation for animal feed.

Recent News about Fermented Food

16/6/2024 Fermented food intake during pregnancy could reduce the risk of neurodevelopment disorders in children - Japanese study

3/7/2024 Europeans are more trusting of precision fermentation than other forms, prefer cost-competitiveness over lower prices for plant-based food, and are divided over the sustainability aspects of alternative proteins, a new survey has found.

26/2/2024 Precision Fermentation Alliance and Food Fermentation Europe Finalize a Refined Definition of Precision Fermentation

20/8/2024 Fermented protein FeedKind now available to European pet food manufacturers

17/1/2024 Mediterranean Food Lab raises $17m series A to scale up AI-powered solid state fermentation tech

Fermented Food Market Segmentation by Product

Dairy Food Types; Yogurt; Kefir; Cheese; Others; Beverages; Kombucha; Water Kefir; Fermented Juices; Fermented Teas; Vegetables; Sauerkraut; KimchiPickles; Others...

by Distribution Channel

Offline; Retail Stores; Health and Wellness Stores; Food service and Restaurants; Others

Online; E-commerce Platforms; Direct-to-Consumer Websites; Others; Fermented Food Market Key Players Nestlé (Switzerland) Danone (France)The Coca-Cola Company (US) PepsiCo (US) Anheuser-Busch InBev (Belgium) Heineken (Netherlands) Mondelez International (US) Kraft Heinz (US) Unilever (Netherlands) Fonterra Co-operative Group (New Zealand) Suntory Holdings (Japan) General Mills (US) Lactalis Group (France) Kirin Holdings (Japan) Yakult Honsha Co., Ltd. (Japan) Groupe Lactalis (France) Grupo Bimbo (Mexico) Campbell Soup Company (US) Calbee, Inc, (Japan)

Key questions answered in the Fermented Food Market are:

What is the growth rate of the Global Fermented Food Market?

Which region is expected to dominate the Global Fermented Food Market?

What is the expected Global Fermented Food Market size by 2030?

Which are the top players in the Global Fermented Food Market?

Key Offerings:

Past Fermented Food Market Size and Competitive Landscape (2018 to 2022)

Past Pricing and price curve by region (2018 to 2022)

Market Size, Share, Size & Forecast by Different Segment | 2024-2030

Fermented Food Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by Region

Market Segmentation - A detailed analysis by segment with their sub-segments and Region

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

§ Competitive landscape - Fermented Food Market Leaders, Market Followers, Regional player

§ Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of Business by Region

Lucrative business opportunities with SWOT analysis

(open PR)

(VAN) The Nhon Hai Purple Shallot Agricultural Cooperative recently began exporting about 3 tons of shallots weekly, becoming the first in the former Ninh Thuan province to do so.

(VAN) OCOP products from Quang Ninh are gradually reaching international markets, with a focus on nationally certified 5-star products.

(VAN) After a sharp decline in the early months of the year, Vietnam's durian exports are experiencing a strong recovery, driving the overall rebound in fruit and vegetable exports.

(VAN) The volume of durians imported through Guangxi has surged as the region invests in logistics infrastructure and takes advantage of tariff incentives from the RCEP agreement between China and ASEAN.

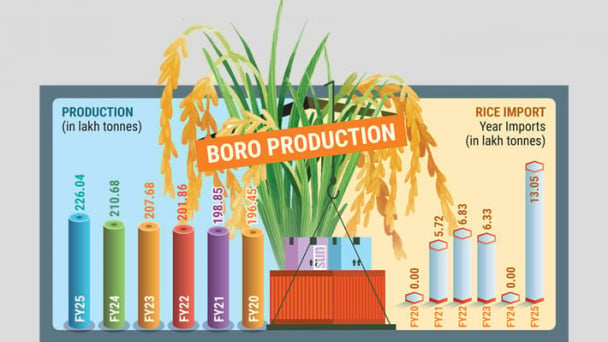

(VAN) Rice prices in Bangladesh have shot up over the past year, rising by as much as 16%, despite a record-breaking harvest this season and large volumes of imports in 2024-25 fiscal year.

(VAN) U.S. seafood tariffs trigger major disruptions in global supply chains. Vietnam proactively shifts markets and strengthens internal capacity to maintain its export position.

/2025/07/26/1437-0-nongnghiep-221433.jpg)

(VAN) To achieve successful exports, Vietnamese agricultural products must tell a product story that aligns with current trends and reaches to the needs and emotions of international consumers.