September 6, 2025 | 13:03 GMT +7

September 6, 2025 | 13:03 GMT +7

Hotline: 0913.378.918

September 6, 2025 | 13:03 GMT +7

Hotline: 0913.378.918

The pepper industry is at risk of losing major markets because the sea freight is too high. Photo: TL.

For Vietnamese pepper, the US is a key market with export volume accounting for 20-25%/year and has always maintained a stable purchasing power until now. The EU is also a key market and the target market of most businesses in the context that free trade agreements are boosting the purchasing power of this market.

However, these are the two sea shipment routes with the most skyrocket and unusual increase in freight rates with an increase of about USD 1,500-2,000 for a 40-foot container every two weeks.

In particular, it is not excluded that the cost increase from the intermediary unit which is shipping agents (FWD) has resonated to create a false mentality on the issue of the price increase. This is also an important link because most businesses work with shipping lines through the intermediary FWD. This has been proven when currently on the market there are many different prices for spaces on the same ship.

Enterprises understand that shipping lines are also being affected in many ways and on a large scale, leading to higher freight rates. However, the increase should be strictly controlled, open and clear, and with a pre-announced schedule.

The number of container cargo through Vietnam's seaports increased sharply in the first 5 months of the year. Photo: TL.

The increase in sea freight rates is a very serious issue that negatively affects the state of pepper export. It is more concerning as the high shipping rates are leading to pepper businesses losing the markets to our direct competitors.

To be specific, recently, many US and EU customers have switched to buying pepper from Brazil because the quality is not too different from that of Vietnam while the transportation cost from Brazil to the US is only 1/3 and to the EU is only 1/10 of that from Vietnam. Therefore, VPA believes that with the current situation of continuously increasing freight rates having zero tendency to go downward as of now, Vietnam's pepper industry will completely lose its competitiveness in the US and EU markets.

The question is whether or not shipping lines deliberately put containers and spaces on ships to create the phenomenon of scarcity of space, scarcity of container shells in order to push freight rates to continuously skyrocket. Because if there is really a shortage of containers, the volume of containers through Vietnam's seaports being so high in the first months of this year is something questionable.

According to Mr. Hoang Hong Giang, Deputy Director of the Maritime Administration (Ministry of Transport), the volume of container cargo through Vietnam's seaports in the first five months of this year was 10,338,000 TEUs, up 24% over the same period in 2020, which is the highest growth rate in the past few years.

Facing difficulties due to sea freight, VPA hopes that the Government, ministries and sectors continue to influence and require carriers to publicize and transparently bring out shipping rates on the company's official website, clear fee schedule; request the authorities to continue direct dialogue with major shipping lines to request shipping agents to apply a common rate increase to avoid the current tariff disturbances, to end the phenomenon of FWD abusing their right to coerce enterprises; clarify the role and function of FWDs (shipping agents), absolutely not allow the phenomenon of agents acting on their own, buy spaces from shipping lines, then add the abnormally high difference and resell them to other export businesses.

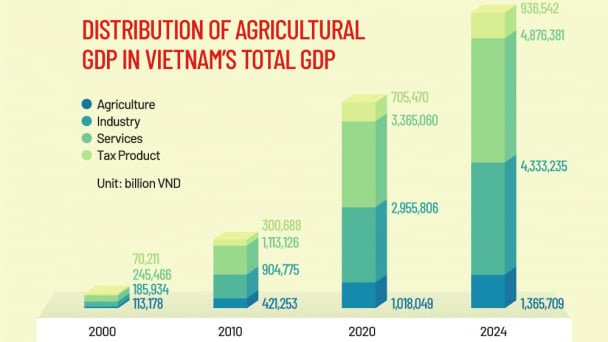

(VAN) The share of agricultural GDP has continued to play an important role in Vietnam’s overall GDP, reflecting the trend toward sustainable economic growth.

(VAN) Vietnam’s export value of agricultural, forestry, and fishery products grew strongly between 2000 and 2024, affirming its position among the world’s top 15 agricultural exporters.

/2025/09/05/2431-2-102010_727.jpg)

(VAN) Vietnam has agreed to establish a joint working group aimed at removing barriers and facilitating deeper penetration of Vietnamese agricultural products into the trillion-dollar Halal market.

(VAN) The EU is a leading market, yet Vietnamese seafood accounts for only 3% of the region’s total imports. The potential remains vast.

(VAN) Bread prices surge 6.5% amid ingredient costs, monopolies; government expands rice discounts.

(VAN) The gap between farmgate and international retail prices shows the potential for Vietnam coconuts to increase value and generate greater profits.

(VAN) In the first 6 months of the year, Lam Dong’s dragon fruit exports recorded impressive growth. However, tightening market standards require changes from both farmers and businesses.