December 2, 2025 | 20:03 GMT +7

December 2, 2025 | 20:03 GMT +7

Hotline: 0913.378.918

December 2, 2025 | 20:03 GMT +7

Hotline: 0913.378.918

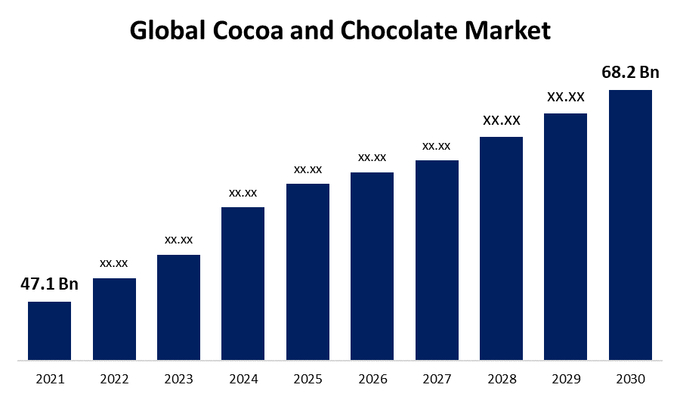

Global cocoa and chocolate market insights forecasts to 2030. Source: Sphericalinsights.

Hershey (NYSE:HSY) shares dropped 2.8% in afternoon trading Wednesday amid reports from Bloomberg News that the company is seeking regulatory approval to significantly increase its cocoa purchases through the New York exchange. This move comes in response to global shortages that have driven cocoa prices to unprecedented levels.

The confectionery giant has approached the US Commodity Futures Trading Commission with a request to buy over 90,000 metric tons of cocoa on ICE Futures US, Bloomberg reported. This quantity represents a substantial increase from the exchange's current limit and would be equivalent to around 5,000 20-foot shipping containers. The request is a clear indication of the pressures Hershey faces as the cocoa market tightens due to a fourth consecutive year of supply shortfalls.

Adverse conditions such as disease and unfavorable weather in the Ivory Coast and Ghana, which are the largest cocoa-producing countries, accounting for over 60% of the world's supply, have exacerbated the situation. The scarcity of cocoa has led to a series of record-high prices, posing a significant challenge for chocolate manufacturers like Hershey.

Hershey's Chief Financial Officer Steve Voskuil had previously cautioned that the company would encounter rising cocoa costs this year. The company's proactive measure to secure a larger supply of cocoa through the New York exchange is a strategic response to these cost pressures. However, the news has raised concerns among investors about the impact of these escalating costs on Hershey's profitability, contributing to the decline in its stock price.

"Hershey has a rigorous commodity procurement process. We are well covered on our cocoa needs for 2025 to make the products our consumers love," a Hershey spokesman said following the report.

As the market continues to monitor Hershey's negotiations with the regulatory body, investors are weighing the potential implications of the cocoa price surge on the company's future earnings. With the global cocoa supply chain under strain, Hershey's efforts to navigate these challenges will be closely watched.

In other recent news, Hershey Co (NYSE:HSY). continues to face challenges from rising cocoa costs, with Citi analyst Thomas Palmer maintaining a Sell rating for the company. The potential impact of cocoa inflation on the company's earnings, particularly in the second half of 2025, has led to a revision of the price target to $159. Hershey's strategy for 2025 includes a net price increase of 3-4%. However, if cocoa prices remain high, further pricing actions could be necessary.

On the merger front, Hershey Trust Co. declined a preliminary takeover bid from Mondelez International Inc (NASDAQ:MDLZ)., potentially ending a deal that could have resulted in combined sales nearing $50 billion. Mondelez responded by announcing a $9 billion stock buyback plan. Moreover, Hershey's President of its U.S. Confection division, Michael Del Pozzo, is set to leave the company, with CEO Michele Buck stepping in on an interim basis.

BofA reinstated Hershey with a neutral rating, setting a $180 price target for the company's stock. This rating is based on a multiple of 21.5 times the firm's estimated earnings per share for the calendar year 2026. These are the recent developments in Hershey Co.'s stock market performance and management changes.

Bloomberg News

(VAN) Despite numerous challenges, Vietnam's key seafood products are maintaining strong momentum, setting the stage for full-year exports to potentially reach USD 11 billion.

(VAN) The signing of a protocol between Viet Nam and China on the export of fresh jackfruit represents a significant milestone in agricultural trade cooperation between the two countries.

(VAN) On November 27, the Ninh Binh Department of Agriculture and Environment and the Institute for Green Growth Research organized a training course on greenhouse gas inventory for businesses.

(VAN) China’s cooking oil is suddenly flooding into India. It all comes down to a soybean surplus that Beijing doesn’t quite know what to do with.

(VAN) An Giang promotes supply-demand connections, standardizes quality and builds value chains, creating a foundation for sustainable bird’s nest development and aiming to expand exports.

/2025/11/24/5339-4-nongnghiep-075331.jpg)

(VAN) Recently, the conference on 'Sustainable Fisheries Linkage Chain - Tilapia for Export' took place in Tien Hai commune, Hung Yen province.

/2025/11/21/4309-2-153400_128.jpg)

(VAN) Green and low-emission rice is paving the way for Vietnamese rice to enter high-end markets, marking the beginning of a transformation journey toward greening and elevating the national rice brand.