September 4, 2025 | 09:54 GMT +7

September 4, 2025 | 09:54 GMT +7

Hotline: 0913.378.918

September 4, 2025 | 09:54 GMT +7

Hotline: 0913.378.918

A consumer looking at a rice sales display at a large supermarket in Seoul on the 3rd. According to the Korea Agro-Fisheries & Food Trade Corporation, on the 2nd, the average retail price of 20kg of rice rose 17.2% from the previous year to 60,294 won. Photo: Yonhap.

Amid rising food prices in South Korea, the cost of staple foods like rice and bread—a common substitute for rice—has surged at an even faster rate.

According to the Korea Agro-Fisheries & Food Trade Corporation (aT) on the 3rd, the average retail price of 20kg of rice the previous day was 60,294 Korean won, a 17.2% increase from last year. After exceeding 60,000 won in late July, the government intervened with discounts to bring it down to the 59,000 won range, but it has now crossed the psychological threshold of 60,000 won again. Statistics Korea’s rice price index for last month also rose 11% compared to the same period a year ago.

Despite chronic oversupply in the domestic rice market, the Ministry of Agriculture, Food and Rural Affairs attributed the retail price hike to competition among local distributors with low inventories ahead of the new harvest season, as they scrambled to secure raw rice. The government has begun releasing large quantities of reserve rice this week and expanded discounts for major retailers from 3,000 won to 4,000–5,000 won per 20kg as part of countermeasures.

Bread prices also jumped 6.5% last month compared to the previous year, according to Statistics Korea’s consumer price index—far outpacing the overall inflation rate of 1.7%. Moreover, bread prices have risen by over 6% for six consecutive months since March. This surge is driven by soaring prices of key ingredients like wheat flour, due to the prolonged Russia-Ukraine war, and other materials such as eggs and milk.

However, a bread buyer at a major supermarket stated, “The recent sharp price increases cannot be fully explained by rising ingredient costs alone,” adding, “A vicious cycle where dominant companies raise prices and others follow has likely contributed.” SPC삼립, which holds an 80% market share in the mass-produced bread retail sector, may have leveraged its monopolistic position to push up prices. There are also suspicions that flour suppliers unilaterally raised prices during negotiations with bakeries over flour supply costs.

Chosun

(VAN) The gap between farmgate and international retail prices shows the potential for Vietnam coconuts to increase value and generate greater profits.

(VAN) In the first 6 months of the year, Lam Dong’s dragon fruit exports recorded impressive growth. However, tightening market standards require changes from both farmers and businesses.

(VAN) Several factors have converged to make 2025 a difficult year for rice farmers and their industry allies.

(VAN) This year, cassava export prices have fallen sharply due to an abundant supply. However, exports of cassava and cassava products have increased significantly, offsetting the decline in prices.

(VAN) The key durian growing area of Central Highlands has implemented various solutions to improve durian quality, aiming for sustainable exports, brand building, and international market expansion.

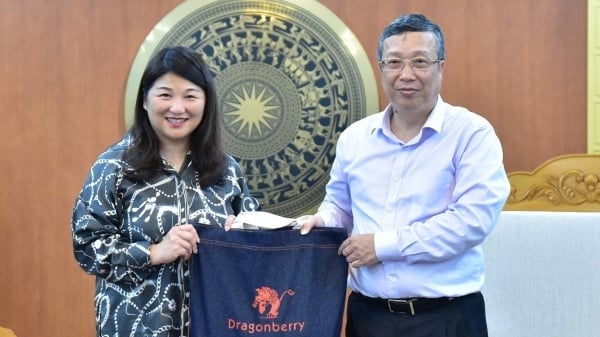

(VAN) Following the successful shipment of fresh lychees to the U.S., Vietnam MAE will support Dragonberry Produce in expanding exports of Vietnamese passion fruit and guava.